[fusion_builder_container hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” overlay_color=”” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” padding_top=”” padding_bottom=”” padding_left=”” padding_right=””][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” border_position=”all” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” center_content=”no” last=”no” min_height=”” hover_type=”none” link=””][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

Finance Lease or Operating Lease? What is the Difference? 2020 Update

Updated: April 2020

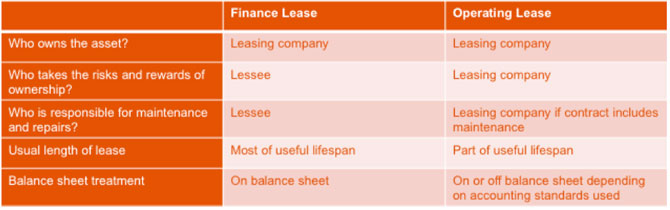

The world of asset finance and leasing isn’t always as clear as it could be. And one of the frequent areas of confusion we come across is understanding the difference between a finance lease and an operating lease. Let’s try to explain…

Generally accepted accounting practice (both SSAP 21 and IAS 17) defines an operating lease as ‘a lease other than a finance lease’. So we need to start with understanding what a finance lease is.

Prefer to watch? Here’s a short video overview:

What is a finance lease?

A finance lease is a way of providing finance – effectively a leasing company (the lessor or owner) buys the asset for the user (usually called the hirer or lessee) and rents it to them for an agreed period.

A finance lease is defined in Statement of Standard Accounting Practice 21 as a lease that transfers

“substantially all of the risks and rewards of ownership of the asset to the lessee”.

Basically this means that the lessee is in a broadly similar position as if they had bought the asset.

The lessor charges a rent as their reward for hiring the asset to the lessee. The lessor retains ownership of the asset but the lessee gets exclusive use of the asset (providing it observes the terms of the lease).

The lessee will make rental payments that cover the original cost of the asset, during the initial, or primary, period of the lease. There is an obligation to pay all of these rentals, sometimes including a balloon payment at the end of the contract. Once these have all been paid, the lessor will have recovered its investment in the asset.

The customer is committed to paying these rentals over this period and, technically, a finance lease is defined as non-cancellable although it may be possible to terminate early.

At the end of the lease

What happens at the end of the primary finance lease period will vary and depends on the actual agreement but the following are possible options:

– the lessee sells the asset to a third party, acting on behalf of the lessor

– the asset is returned to the lessor to be sold

– the customer enters into a secondary lease period

When the asset is sold, the customer may be given a rebate of rentals which equates to the majority of the sale proceeds (less the costs of disposal) as agreed in the lease contract.

If the asset is retained, the lease enters the secondary period. This may continue indefinitely and will come to an end when the lessor and lessee agree, or when the asset is sold.

The secondary rental may be much lower than the primary rental (a ‘peppercorn’ rental) or the lease may continue on a month by month basis at the same rental.

A finance lease example

Finance lease is commonly used for financing vehicles, particularly hard working commercial vehicles, where the company wants the benefits of leasing but does not want the responsibility of returning the vehicle to the lessor in a good condition.

Beyond commercial vehicles, finance lease can be used for many other assets, here’s one example:

A health club was looking to invest in new gym equipment. The total amount financed was £20k with the agreement set to 60 monthly payments with no deposit. Crucially the balloon payment was set to £0, meaning the client (or more likely their gym users!) is free to really sweat the equipment knowing that there is no liability at the conclusion of the agreement. The option after 60 months will be to sell the equipment – retaining funds made, or to enter a peppercorn (secondary) rental period for a relatively small amount.

Operating lease

In contrast to a finance lease, an operating lease does not transfer substantially all of the risks and rewards of ownership to the lessee. It will generally run for less than the full economic life of the asset and the lessor would expect the asset to have a resale value at the end of the lease period – known as the residual value.

This residual value is forecast at the start of the lease and the lessor takes the risk that the asset will achieve this residual value or not when the contract comes to an end.

An operating lease is more typically found where the assets do have a residual value such as aircraft, vehicles and construction plant and machinery. The customer gets the use of the asset over the agreed contract period in return for rental payments. These payments do not cover the full cost of the asset as is the case in a finance lease.

Operating leases sometimes include other services built into the agreement, e.g. a vehicle maintenance agreement.

Ownership of the asset remains with the lessor and the asset will either be returned at the end of the lease, when the leasing company will either re-hire in another contract or sell it to release the residual value. Or the lessee can continue to rent the asset at a fair market rent which would be agreed at the time.

Accounting regulations are under review, however at the current time, operating leases are an off balance sheet arrangement and finance leases are on balance sheet. For those accounting under International Accounting Standards, IFRS16 will now bring operating lease on balance sheet – read more about IFRS16 here.

A common form of operating lease in the vehicle sector is contract hire. This is the most popular method of funding company vehicles and has been growing steadily.

Why choose one type of lease over the other?

This is a complex question, and each asset investment should be considered individually to ascertain which type of funding is going to be most advantageous to the organisation. There are, however, two key considerations; the type and lifespan of the asset and how the leased asset will be reflected in the organisation’s accounts.

Type and lifespan of the asset

As mentioned above, the key thing to remember is that under an operating lease the risks and rewards of owning the asset remain with the lessor, under a finance lease these are largely transferred to the lessee.

In very general terms, if the asset has a relatively short useful lifespan within the business, before it will need to be replaced or upgraded, an operating lease might be the more commonly selected option. This is because the asset is likely to retain a significant proportion of its value at the end of the agreement and will therefore attract lower rentals during the lease period. As the lessor is taking the risk in terms of the residual value of the asset, this will be priced into the overall cost of the contract.

For assets where it is possible to influence the condition at the point of return to the lessor, and therefore give greater certainty to residual value estimates, this ‘cost of risk’ can be significantly reduced. Asset types where this is the case include cars, commercial vehicles and IT equipment.

If the asset is likely to have a longer useful life within the business, then considerations of its residual value become less critical, as this is likely to be a much smaller proportion of its original value. This may mean that the lessee is happy to take this risk in-house rather than paying a charge to the lessor for it. Here, finance lease is a more obvious choice.

As the rentals paid under a finance lease pay off all, or most, of the capital, it’s often possible to arrange a secondary rental period, and retain use of the asset, at a much reduced cost.

Accounting treatment of finance and operating leases

The treatment of the two different lease types depends on which accounting standards the organisation adheres to.

For organisations that report to International Financial Reporting Standards (IFRS), the introduction of IFRS16 from 1st January 2019 means that both operating leases and finance leases must be reflected in the company balance sheet and profit and loss account. Prior to this, operating leases were treated as ‘off-balance sheet’ items.

Most small and medium-sized enterprises currently report to the UK’s generally accepted accounting principles (UK GAAP). The change to the treatment of leases will only filter through to companies applying UK GAAP if they convert to IFRS/FRS 101 Reduced Disclosure Framework, rather than FRS 102. The expectation from the FRC is that the earliest UK adoption could be 2022/23, but it will be monitoring and watching the international impact until then.

For businesses that do now have to reflect operating leases in their accounts, the impact is as follows:

- Balance Sheets – lessees will need to show their ‘right to use’ the asset as an asset and their obligation to make lease payments as a liability.

- P&L accounts – lessees will show depreciation of the asset as well as interest on the lease liability. The depreciation would usually be on a straight-line basis.

For businesses that are not affected by these changes, the ability to fund assets while keeping them off-balance sheet can be the deciding factor in selecting between operating and finance leases.

> You can read answers to other asset finance FAQs here

Annual Investment Allowances

Many organisations seek to maximise the corporation tax benefits of utilising their Annual Investment Allowances (AIA) when acquiring new assets. These allowances provide organisations with instant tax relief on 100% of the cost of a newly acquired asset. Since 1st January 2019 the allowance has increased to £1m per annum.

However, to qualify for this relief the assets must be ‘purchased’ and not ‘leased’. This means that assets financed through both operational and finance leases are not eligible for AIAs, but assets acquired using funding methods such as contract purchase and hire purchase are.

To find out more about Annual Investment Allowances click here.

Summary

The classification of a lease as either a finance lease or an operating lease is based on if the risks and rewards of ownership pass to the lessee. This can be subjective and it is important that the leasing contract is carefully reviewed.

So, it turns out that giving a simple explanation isn’t that simple! If there’s anything you think needs clarifying further or you have any questions, please add in the comments below.

You may also be interested in:

>> Coronavirus Finance Options

>> Tax Implications of Business Car Leasing

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]

all Kamasutra styles, lotus flower, group sex, sex for two, all kinds of kisses, and much more in Dehradun. No negative reviews or hidden costs for Dehradun escort service.

http://tanubhatia.com/

nice

which makes you very down and upset after meeting and till that time you just call the agency and give a negative comment but very few people are ready to accept their mistake and rectify their way of doing the services so that they can enjoy some class services next time.

Thanks for sharing such important information which is very useful .I really appreciate your way of work.

https://urbanbania.com/

https://www.marvelousjourneys.com/

https://marvelousjourneys.com/singhtseen/

Thanks for sharing such important information which is very useful .I really appreciate your way of work.

Thanks for sharing such important information which is very useful .I really appreciate your way of work.

There is definately a great deal to know about this topic. I love all the points you’ve made. Also visit my site Graphical Dot Plan Software

Hurrah! In the end I got a website from where I can actually take helpful data concerning my study and knowledge.

When it comes to leasing assets, businesses have two primary options: finance lease and operating lease. Both types of leases offer distinct advantages and considerations, making it essential for companies to understand their differences in order to make informed decisions.

In this section, we will explore the key differences between finance lease and operating lease, shedding light on their unique characteristics and implications for businesses. By understanding the nuances of each type of lease, you can determine which option aligns best with your organization’s financial goals and requirements.

So, whether you’re a business owner seeking to acquire assets or an individual looking to expand your knowledge in finance, this section will provide you with valuable insights into the world of leasing. Let’s delve into the details and unravel the intricacies of finance lease versus operating lease.

Usually, students fail to deal with their Diploma course assessment tasks owing to lack of understanding of the course. Are you experiencing the similar grudge with your academic tasks? If yes, then you are not the only one, as it is quite common with a number of students of your age. At such a point, it is always recommended to approach Diploma Assignment Help and cater all your academic needs precisely and within the specified deadline!

Finance lease, operating lease, differences, advantages, and disadvantages

When leasing assets, there are two options to consider: finance leases and operating leases. While both options allow businesses to use assets without upfront purchase costs, they differ in ownership and financial implications.

A finance lease is a long-term agreement where the lessee essentially takes on the role of the owner. The lessee bears most of the risks and rewards associated with ownership and typically has a purchase option at the end of the lease term. This type of lease for acquiring high-value assets such as machinery or vehicles.

A finance lease is a type of lease that transfers most of the risks and rewards associated with owning an asset to the lessee. In this case, the lessee is responsible for maintenance costs, insurance, and other expenses related to the leased asset. At the end of the lease term, the lessee usually has the option to purchase the asset at a predetermined price.hehe boiii

Finance Lease, Operating LeaWhen it comes to leasing, understanding the difference between a finance lease and an operating lease is crucial. These terms are often used interchangeably, but they actually have distinct characteristics and implications for businesses.

A finance lease is a type of lease that transfers most of the risks and rewards associated with owning an asset to the lessee. In this case, the lessee is responsible for maintenance costs, insurance, and other expenses related to the leased asset. At the end of the lease term, the lessee usually has the option to purchase the asset at a predetermined price.

On the other hand, an operating lease is more like renting. It allows businesses to use an asset for a specific period without assuming ownership or long-term obligations. The lessor retains ownership and responsibility for maintenance and other costs associated with the asset.

These distinctions have significant implications for financial reporting and tax treatments. Finance leases are typically recorded as assets on balance sheets, while operating leases are treated as operating expenses.

Understanding these differences can help businesses make informed decisions about their leasing options based on their specific needs and financial goals. Whether it’s acquiring assets for long-term use or simply accessing them temporarily, knowing whether a finance or operating lease is more suitable can save time, jjjmoney, and potential headaches in the future.se, differences, accounting treatment, ownership, lease term

Finance Lease, Operating LeaWhen it comes to leasing, understanding the difference between a finance lease and an operating lease is crucial. These terms are often used interchangeably, but they actually have distinct characteristics and implications for businesses.

A finance lease is a type of lease that transfers most of the risks and rewards associated with owning an asset to the lessee. In this case, the lessee is responsible for maintenance costs, insurance, and other expenses related to the leased asset. At the end of the lease term, the lessee usually has the option to purchase the asset at a predetermined price.

On the other hand, an operating lease is more like renting. It allows businesses to use an asset for a specific period without assuming ownership or long-term obligations. The lessor retains ownership and responsibility for maintenance and other costs associated with the asset.

These distinctions have significant implications for financial reporting and tax treatments. Finance leases are typically recorded as assets on balance sheets, while operating leases are treated as operating expenses.

Understanding these differences can help businesses make informed decisions about their leasing options based on their specific needs and financial goals. Whether it’s acquiring assets for long-term use or simply accessing them temporarily, knowing whether a finance or operating lease is more suitable can save time, money, and potential headaches in the future.se, differences, accounting treatment, ownership, lease term

Usha Solar is the name that comes to mind. Their commitment to quality and innovation is evident in their products. As one of the leading solar panel manufacturing companies in India, Usha Solar offers high-performance panels that generate clean and sustainable energy. I highly recommend considering their solar panels for your renewable energy needs.

very nice article and very informative

The team of Ask Me Assignment offers a world-wide online platform for personalised assignment writing. Students in the need of assignment assistance are particularly fond of our platform. With us, you have discovered a website you can depend on for requests for assignment help, and we’ll work hard to create your assignments at the finest calibre.

Thanks for sharing such important information which is very useful .I really appreciate your way of work

I think this is a really good document. I saved this page and will go back frequently to read any fresh entri

“Thank you for sharing this informative article. I particularly liked how you explained [concept] in a simple and concise manner. It made it much easier for me to grasp.”

It’s a popular Indian betting website that offers amazing features for online gambling. Many Indian bettors are flocking to Lotusbook247 because it provides fantastic services and an exciting experience.

Lotusbook247 is an exciting new online betting site that offers a range of innovative features. Our Lotusbook247 login ensures a seamless starting point for your betting journey. There are numerous advantages to playing with Lotusbook247.

Good post, sir thanks for sharing

Get help with HI5020 Corporate Accounting Assignment

Get HI5020 Corporate Accounting with Punjab Assignment Help at an affordable price and quality delivery on time.

Thanks for sharing this blog. Looking for Assignment Helpers ? Then hire our experienced & reliable experts who can help you with any type of assignment. Order now!

Looking for Assignment Helpers ? Then hire our experienced & reliable experts who can help you with any type of assignment. Order now!

Thanks for sharing such important information which is very useful .I really appreciate your way of work.

During this post, you have shared fantastic content. This article provided me with some useful knowledge. Thank you for sharing that. Keep up the good work.

Thanks for sharing this information. You can also visit my website here at تیغ کوچک خلال کن پروانه ای و دیواری

Thank you for sharing excellent information

Thanks for the great tips. Now my work is very easy for the reply to the Google Maps Reviews. I implement it right now.

I highly recommend the HND Assignment Help guide to any HND student looking for a comprehensive resource that provides exceptional service. The authors have done an excellent job of addressing the needs of students and providing actionable steps to help them achieve success in their studies.

Zech Autos bietet durch seine langjährige Erfahrung im Autohandel und Gebrauchtwagenhandel den perfekten Service beim Kauf Ihres Neuwagens oder Verkauf Ihres Altwagens.

This service offers a variety of services, from writing essays and dissertations to helping with research, formatting, editing, and proofreading.

Get your food delivery business on the go with our custom Food Delivery App Development Company services.Our team of expert developers creates tailored food delivery apps with seamless ordering and delivery features to cater to your business needs.

Your Article Is Well Written And Simple To Understand. You Make Excellent Points. Keep sharing more related blogs.

Your blog is unique, I liked it.

Great information.

Thanks for your great article friend, i get new information, new ideas to do somethings, i hope you will share again, i keep waiting for next post, thanks.

Nice Article. Thanks for sharing this informative article to us. Keep sharing more related blogs.

Great analysis, but can you still post another blog about this, discussing which way is better when it comes to leasing, either way I think they have their own pros and cons.

Thanks for sharing this article to us. I gathered more useful information from your blog. Keep sharing more related blogs.

Thanks for Sharing Such An Interesting Article, It Is Really Worthy To Read. Keep sharing more related blogs.

Thanks for Sharing Such An Interesting Article, It Is Really Worthy To Read. Keep sharing more related blogs.

Thanks for sharing such important information which is very useful .I really appreciate your way of work.

Hire mobile app, custom web app team & digital marketers on hourly, fixed price, monthly retainers

You said everything perfectly

The quality of education is high in the Australia and that’s why students there prefer to help from assignment help so that they can complete their assignments within the deadline and as per the requirement.

If you are stuck on a management assignment, If you need to ask a question on how to write my assignment on management, how to write management summaries, or if you need help completing your management assignment, then bestassignmentexpert can help!

I was having difficulty understanding this point. But your post clear all our doubts.

It is also possible to get the CDR report Engineers Australia if you are planning to move to Australia.

Your blogs are great.

3D rendering examples the creation of an idea requested by a client it may be a real-world object or an imaginary that represented in a sketch say, architectural, interior design or products.

Are You Looking for Company Formation in Dubai JSB Incorporation largest and most trusted Business Setup Company in Dubai. JSB Incorporation Has formed 5000+ companies since 2020. Quick and Efficient Company Formation in Dubai, UAE.

Really jubilant to say, your post is exciting to read. I never stop myself to say something about it. You’re doing a great job.

Getting the MATLAB Assignment Help is beneficial for you in case you cannot determine the right fact for attaining the most validated answer in the defined time. Nobody should have to stress about running the basic idea and implementing it in real-time concern. If you need MATLAB assignment help, it is essential to find a reliable and experienced provider who can offer quality assistance at a reasonable cost. You can search online for reputable MATLAB assignment help services, read reviews and compare prices before choosing one that suits your needs.

An electric bike is a great way to get around without having to rely on costly and polluting transportation such as cars. Electric bicycles offer a host of benefits to the user. For starters, they are more environmentally-friendly than traditional gas-powered vehicles, which can help reduce carbon emissions and your environmental footprint. Secondly, they provide an excellent workout that combines cardiovascular exercise with muscle toning.

Your writing style is engaging and informative. Keep up the good work!

There are many websites and platforms that offer online assignment help. Some popular ones include Chegg, These services provide access to tutors and subject matter experts who can help you with your homework and projects. Additionally, some websites offer pre-written solutions and study materials to help you with your studies. It’s important to thoroughly research and read reviews before choosing a service to ensure you get the help you need.

Students who are given assistance in statistics may also be led step-by-step through the process of showing statistical data in either a diagrammatic or tabular fashion. In the discipline of visual analytics, both of these methodologies are used in tandem with one another. And all of us are aware of how vitally crucial it is in the field of contemporary statistics to display data in an understandable manner. The pay someone to take my online exam service allows you to complete even the most difficult data visualisation tasks in the allotted time.

If you are stuck on a nursing assignment, If you need to ask a question on how to write nursing essays, how to write nursing summaries, or if you need help completing your nursing assignments, then Assignmenthelpservice can help!

Rather than doing our homework ourselves, we can pay someone to do it for us online. You’ll never have to worry about assignments again! 24 hours a day, we offer original, superior essay writing services in Australia. Get the finest best service at less costly rates with bright project assistance. Students can also have difficulty understanding the project’s problem and the supervisor’s expectations. Contact “Get homework help online service” for Top Quality mission professionals. Additionally, some students will not be able to paint at the complex demands of the entire project, or they lack the writing skills needed to excel in online classes. You can obtain excellent grades in every aspect of your academic career when we look after your capabilities. As a result of coursework help services, college students are happy and proud of themselves.

nice Excellent content provided in this wonderful place CongratulationsThank you for sharing this

Really jubilant to say, your post is exciting to read. I never stop myself to say something about it. You’re doing a great job

I like finance post

Good explanation.

Nevertheless in the case of the finance lease I don’t understand you don’t clearly state that at the end of the lease period the lessee becomes the owner of the asset??. Just from the moment he pays the last rental.

Ordinarily I don’t learn post on websites, yet I wish to say that this review amazingly forced me to attempt to do it! Your composing taste has been shocked me. Much appreciated, very great post.

I always spent my half an hour to read this web site’s posts daily along with a cup of coffee.

Regularly I don’t learn on sites, yet I wish to say that this review very constrained me to attempt to do it! Your composing taste has been shocked me. Much obliged, very great post.

Very soon this website will be famous amid all blogging visitors, due to it’s good articles

Usually I do not learn post on blogs, but I wish to say that this write-up very forced me to take a look at

What if you are leasing land for 10 years. How do you treat the value of the land in the books of accounts?

Hola Xin Yi,

Helpful information. Lucky me I discovered your web site by accident, and

I’m stunned why this accident did not happened earlier!

I bookmarked it.

I visited several websites except the audio quality for audio songs present at this website is truly fabulous.

Excellent beat ! I would like to apprentice while you amend your website, how can i subscribe for a blog website?

The account aided me a acceptable deal. I had been a little bit acquainted of this

your broadcast offered bright clear concept

What’s up, I log on to your blog like every week. Your humoristic style is

awesome, keep it up!

Hi there to all, the contents existing at this website

are genuinely awesome for people experience, well, keep up the nice work fellows.

Nice discussion, Ilias! I particularly like the concept of a ‘chain of users’, and that matches my own experience with climate and weather forecasts that are used for streamflow forecasting, that is used for water management decisions, that in turn influence agriculture and energy management decisions, and so on.

Who is the lessor in leasing contract

Can You allow the Monthly rentals of a Finance Lease aganst TAX as an expense, like the rent of an office for exmple?

Hi Stephen

Assets acquired under finance leases are recorded as depreciating asset in a lessees books and a finance lease liability is then recorded, representing the obligation to pay future rentals to the lessor.

These are initially recorded at the present value of the future minimum lease payments which, in practice, means the capital value of the asset.

The asset is depreciated over its useful life as for any other asset, and the finance liability unwinds as lease payments are made.

Hope that helps

Best wishes

Catherine

How then are we suppose to record the assets in the books of the leesee (The borrower), in the following scenario. I applied for a Finace lease from the bank to buy 4 movable assets.The bank then paid the supplier and all necessary paper work between the bank and the supplier were reatined by the Bank.The assets were then delivered to my premises.How am i suppose to treat them in the books of accounts, to gether with the Finance lease?

Because with finance lease “substantially all of the risks and rewards of ownership of the asset to the lessee” and so technically the lessee has committed to ‘buying’ the asset. In practise, there may be solutions if it became necessary to terminate early.

why finance lease is non cancellable

Can I please get a clarification on the treatment of Rent on both Finance and Operation lease? Are the rent set off against the UK Company profit in either situation? But bring to the balance sheet only on the Finance Lease? Book entry being; Debit Asset and Credit Lease company as a creditor?

Finance or operating leases are tax based arrangements whereby, generally, the right to claim the writing down allowances are held by the Lessor and, where the Lessee is a business making a taxable profit, the Lessee can set the rental payments against these profits. If, at the end of the lease period, there was a transfer of title to asset to the Lessee then the arrangement would look more like Hire Purchase. There is, therefore, the risk that the tax authorities would insist on reversing the Lessor’s allowances claim and reverse the Lessee’s profit reduction. Under Hire Purchase the tax allowances sit with the Lessee and only the interest element can be charged against tax.

On disposal it is acceptable for the Lessor to sell the asset to an “unconnected third party”. If this definition does not extend to family members then the sale could be made to that family member.

“Is it acceptable for that family member to sell back to the original lessee? If not, why not?” – the thing you have to avoid is something looking like a device to fool HMRC. In other words the intention all along was to sell to the Lessee but a family member was put into the middle of the transaction to get around the problem referred to above. If it is a device, it is capable of challenge.

Hope that helps.

Hello Catherine, what is it about UK structures that avoids ownership to pass to the lessee but it is acceptable to pass to a family member? Is it acceptable for that family member to sell back to the original lessee? If not, why not? Thank you

It’s similar, yes. And lease payments are often referred to as rentals.

Thank you very much, I find it reach. But in the operating lease would you call it rent like when you pay for one year House rent.

Under UK structures, ownership can not pass to the lessee. This is possible with other funding structures such as contract purchase.

The leasee has an option to purchase that asset at the end of the lease term

Dear Karma, Thank you for your question. I think the first thing to say is that your best bet is to get advice from your auditors/accountants. The second thing to say is that I have seen different advice from different auditors/accountants (so I suspect that there is a degree of subjectivity to this).

There are a number of factors which determine whether something is capable of being treated as an operating lease or finance lease.

2 key issues are: (a) whether the lease transfers “substantially all the risks and rewards of ownership” to the lessee; and (b) whether the lease is for substantially all of the useful working life of the equipment.

So I suspect that in your example, if at the end of 4 years a lessor was carrying a genuine residual exposure in the equipment of 25% and its margin return was dependent upon recovering that residual investment then it would satisfy the first test above (bear in mind the old SSAP21 90/10 rule).

It may not satisfy the second test but this may not be fatal to you. You would need to look at things like the return conditions, the inherent rate charged over the 4 year term, the ability of the lessor to use the equipment in another environment (i.e. whether the equipment was made to the order of the lessee and has no real practical application elsewhere).

It would be good to have an idea of the equipment to which you refer.

Hope this helps

Robert Eggleston

In case of Operating Lease, what would be the maximum length of the lease period. I know it should be less than useful life of the equipment.

If the useful life of the equipment is 5 years, could you do a 4 years Operating lease? According to some advise I have recieving you can only go upto p 75% of the useful life of the equipment. Which would be 3 years & 9 months and therefore doing a 4 year lease wouldn’t qaualify as Operating lease. Is this correct?

Thanks,

Karma

Joaquin, many thanks for leaving a comment. Under UK accounting rules, title to equipment does not transfer at the end of a finance lease. Indeed, there is a risk that, if a leasing company makes that commitment (at the inception of a lease) it effectively creates a lease purchase transaction. The result of that would be to shift the right to claim writing down allowances and also change the tax relief that could be claimed (under a finance lease you can, providing you pay UK corporation tax, set the rental off against the tax liability but with lease purchase can only set the interest off against tax). It would be common at the end of the lease term to agree a secondary rental (often called a “peppercorn”). I understand that a Capital Lease in the USA has a different treatment.

Good explanation.

Nevertheless in the case of the finance lease I don’t understand you don’t clearly state that at the end of the lease period the lessee becomes the owner of the asset??. Just from the moment he pays the last rental.

I am glad to follow leasing experts as you.

Congratulations

Joaquin Gual