[fusion_builder_container hundred_percent=”no” hundred_percent_height=”no” hundred_percent_height_scroll=”no” hundred_percent_height_center_content=”yes” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” status=”published” publish_date=”” class=”” id=”” border_size=”” border_color=”” border_style=”solid” margin_top=”” margin_bottom=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” gradient_start_color=”” gradient_end_color=”” gradient_start_position=”0″ gradient_end_position=”100″ gradient_type=”linear” radial_direction=”center center” linear_angle=”180″ background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ background_blend_mode=”none” video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” filter_hue=”0″ filter_saturation=”100″ filter_brightness=”100″ filter_contrast=”100″ filter_invert=”0″ filter_sepia=”0″ filter_opacity=”100″ filter_blur=”0″ filter_hue_hover=”0″ filter_saturation_hover=”100″ filter_brightness_hover=”100″ filter_contrast_hover=”100″ filter_invert_hover=”0″ filter_sepia_hover=”0″ filter_opacity_hover=”100″ filter_blur_hover=”0″][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” hover_type=”none” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” border_radius=”” box_shadow=”no” dimension_box_shadow=”” box_shadow_blur=”0″ box_shadow_spread=”0″ box_shadow_color=”” box_shadow_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”” margin_bottom=”” background_type=”single” gradient_start_color=”” gradient_end_color=”” gradient_start_position=”0″ gradient_end_position=”100″ gradient_type=”linear” radial_direction=”center center” linear_angle=”180″ background_color=”” background_image=”” background_image_id=”” background_position=”left top” background_repeat=”no-repeat” background_blend_mode=”none” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” filter_type=”regular” filter_hue=”0″ filter_saturation=”100″ filter_brightness=”100″ filter_contrast=”100″ filter_invert=”0″ filter_sepia=”0″ filter_opacity=”100″ filter_blur=”0″ filter_hue_hover=”0″ filter_saturation_hover=”100″ filter_brightness_hover=”100″ filter_contrast_hover=”100″ filter_invert_hover=”0″ filter_sepia_hover=”0″ filter_opacity_hover=”100″ filter_blur_hover=”0″ last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

Don’t Miss Out on Your Annual Investment Allowance

It has been almost a year since Phillip Hammond introduced the most generous Annual Investment Allowance (AIA) increase. In January 2019, the new £1 million allowance limit came into force which delivers 100% tax relief in the year of purchase on the cost of a wide range of assets, including plant and machinery, LCVs, HGVs and other commercial vehicles. The allowance is available for the vast majority of business structures; only partnerships where one of the partners is a company or another partnership are excluded.

How does the Annual Investment Allowance work?

The Annual Investment Allowance provides a 100% tax relief in the year of purchase over the cost of a range of assets for businesses. In simple terms, any business that has profits before tax of up to £1,000,000 has the opportunity to reduce their tax bill to zero when buying business assets such as plant and machinery or commercial vehicles. By offering this incentive, it also provides an opportunity for businesses to grow and expand through their purchases and investments.

The Annual Investment Allowance has long been a tool used by the government to influence the level of capital investment being made by businesses in the United Kingdom. Due to the increase in allowance from a previous amount of £200,000, it’s clear to see that the government is aiming to encourage business asset investment, growth and progression.

For more information on how the Annual investment Allowance works click here.

What type of assets are allowed with AIA?

Annual Investment Allowances are available on a wide range of business assets, including plant and machinery, LCVs, HGVs and other commercial vehicles. Plant and machinery covers many assets that a business may purchase however, it does not include cars, buildings or land.

Act now, before it’s too late!

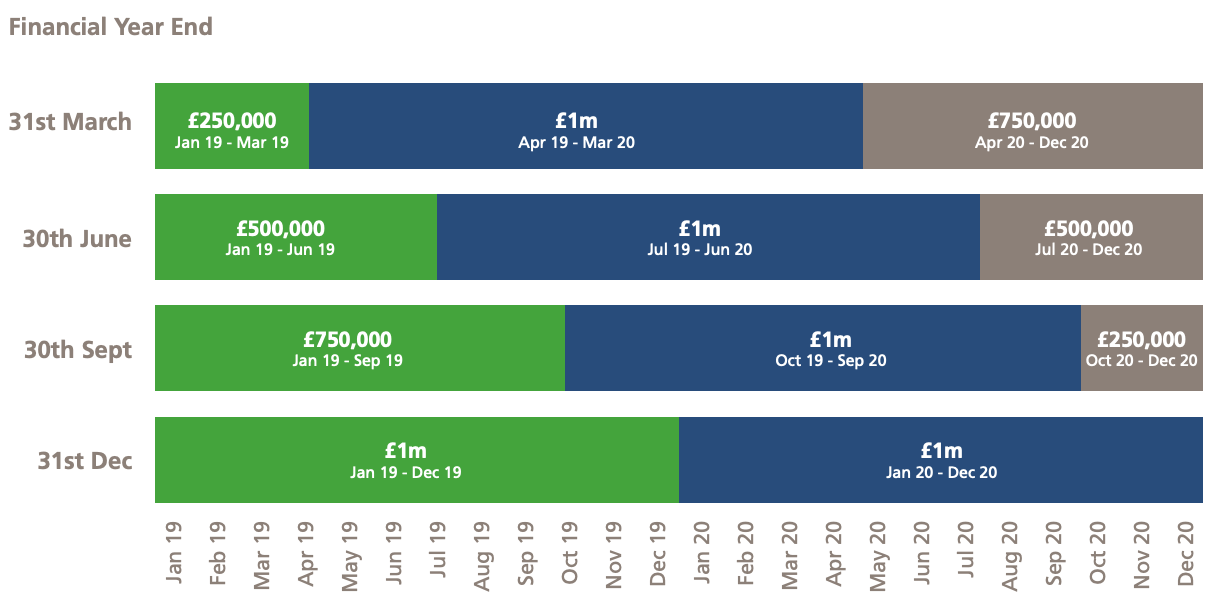

As the end of year is approaching quickly, and with it the financial year end for many organisations, it is important that they are aware of looming deadlines for making the most of the great tax benefit.

For most businesses with a year end of December that have not yet used their allowance, they will lose the 2019 investment allowance at the end of the year. Although there will be another £1 million allowance in 2020.

Those businesses with financial year ends that do not correlate to the calendar year end should also be aware and will need to make sure they are prepared otherwise they could risk missing out. It is important that companies check the times on orders on plant and machinery, LCVs, HGVs and other commercial vehicles as the relief is only available to purchases made in the financial year of 2019 and 2020.

Why is timing crucial?

In order to make the most of the benefit of the AIA, it is imperative that businesses time their capital purchases so that they don’t miss out on the opportunity to claim the maximum AIA and risk paying more tax than they need to. The amount of tax benefit you can receive is dependent on the amount spent on business assets and the point at which a business is in their financial calendar. For example, if a business decided to purchase a business asset in November 2019 to the value of £800,000, they will be able to have access to another one million in tax relief in the year of 2020. This will provide a great opportunity for businesses to grow and expand their business assets.

The tax benefit can also be used if assets are acquired through finance agreements such as Hire Purchase. This means that businesses that do not have access to large amounts of cash can still benefit from the AIA.

If you are planning on making an investment on plant and machinery or commercial vehicles, make sure you understand the deadlines so you don’t miss out!

It is not clear what will happen after 2020 to the Annual Investment Allowance, but learning from the past, amounts tend to fluctuate. For example, in the years between April 2014 and December 2015, the AIA allowance was £500,000 compared to from 2016 to 2018 when the annual investment allowance was £200,000. Therefore, it would be wise to take advantage of the Annual investment allowance whilst it still lasts!

Get the right advice

Maxxia’s experts can provide advice and guidance on the most appropriate form of finance for many types of assets, including hire purchase arrangements that are eligible for Annual Investment Allowances.

As with all taxation matters, and to get the timings of purchases right in order to take advantage of the tax benefits, it is important to consult with your tax advisor or accountant before making any investment decisions.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]

The government is attempting to foster a business environment favorable to investment, expansion, and product diversification. If the property is acquired through a Lease or similar financial arrangement, tax benefits may also be utilized. Thus, AIA is accessible even to companies with limited financial resources.